Blog

Attracting Capital and Creating Wealth for Businesses and People

Hong Kong offers a diversified range of services as an international financial centre. In addition to its securities and bond markets, green and sustainable finance, offshore Renminbi business, and fintech, the asset and wealth management (WAM) sector has seen accelerated growth in recent years.

Hong Kong practises common law and boasts a robust rule of law, maintains the free flow of capital, and has a simple tax system with low tax rates and no estate duty. It is home to a wealth of talents. Combined with unparalleled access to Mainland capital markets and its strategic location within the vibrant, populous, and relatively affluent Guangdong-Hong Kong-Macao Greater Bay Area (GBA), international financial institutions hold strong confidence in the outlook for Hong Kong’s WAM business. Despite geopolitical challenges, many financial institutions have expanded their operations in Hong Kong. Some have rented more office space for business growth, while others have planned to relocate their global heads of asset management to Hong Kong or substantially increase the number of wealth management positions in the city.

With staunch support from the Central People’s Government, measures benefitting Hong Kong are being rolled out one after another. The GBA is developing and growing more vibrant. We are also implementing various initiatives, such as offering tax incentives to attract family offices, implementing the New Capital Investment Entrant Scheme (New CIES), and introducing measures to attract enterprises and talents. We are confident that this positive trend will continue, and Hong Kong’s WAM business will secure a leading position globally.

|

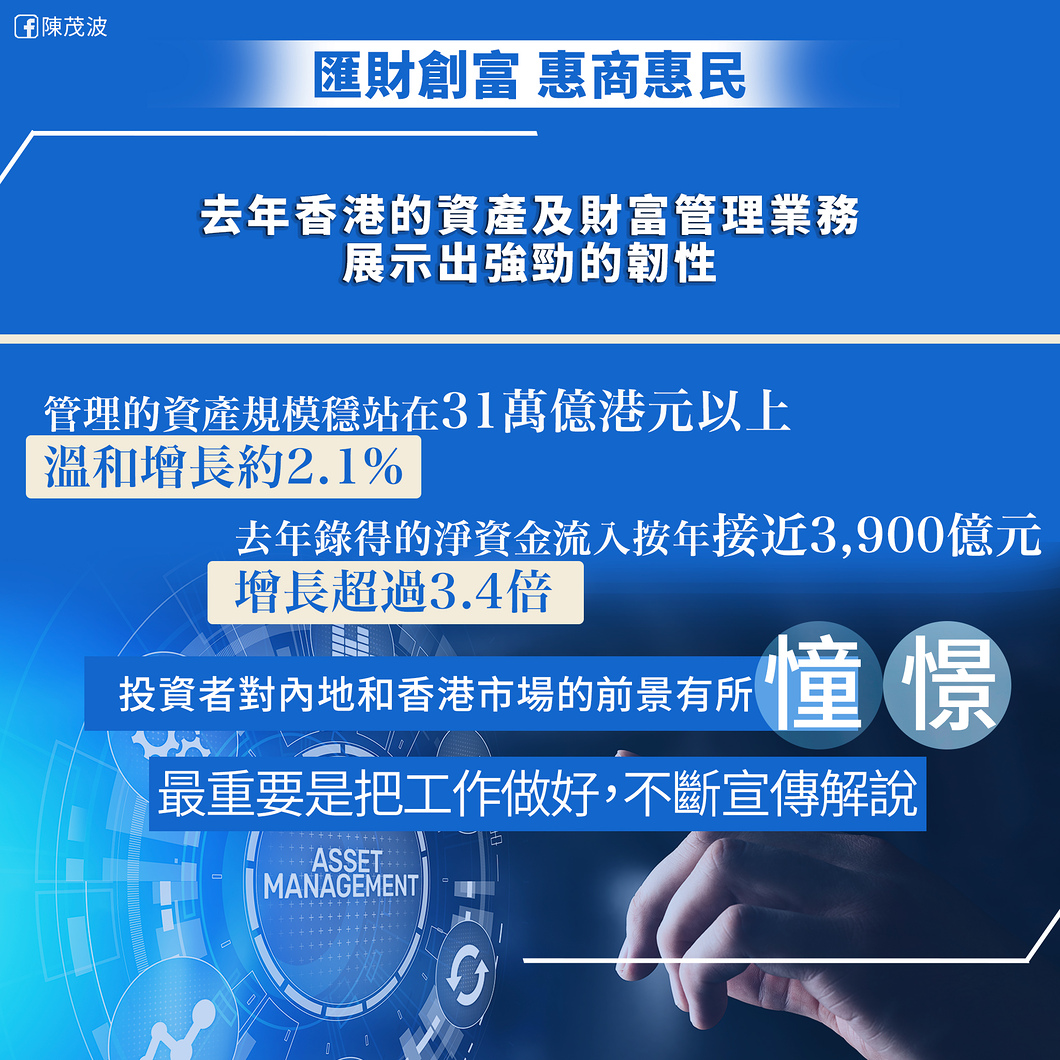

Hong Kong’s financial markets experienced a challenging year in 2022. Despite the headwinds last year, Hong Kong’s WAM business displayed strong resilience. The Securities and Futures Commission will release the 2023 edition of the Asset and Wealth Management Activities Survey later this month. Against a drop of about 13.8% in the Hong Kong stock market last year, the assets under management in Hong Kong stood firmly above HK$31 trillion, growing moderately by 2.1%, with nearly two-thirds of the funds sourced from non-Hong Kong investors, similar to past levels. The private equity funds’ capital under management also recorded steady growth last year, amounting to over HK$1,700 billion. Hong Kong continued to be second largest PE management hub in Asia, trailing only after the Mainland. Benefitting from robust growth in the private banking and private wealth management business, Hong Kong registered net fund inflows of close to HK$390 billion, representing a year-on-year increase of over 3.4 times. Net fund inflows were strong for Hong Kong-domiciled funds as well, increasing year-on-year by over 90% to HK$87 billion. These facts prove that concerns about outflows of funds from Hong Kong were unwarranted.

The above figures also reflect that despite uncertainties arising from international geopolitics, investors around the globe continue to view the development of the Mainland and Hong Kong markets favourably. It is important that we do our part well, and continue to explain to the outside world the steady development of our country, the strong support from the Central People’s Government towards Hong Kong, and our distinct advantages under the “one country, two systems” principle.

As we worked to promote diversified fund structures in Hong Kong over the past few years, the number of registered open-ended fund companies (OFCs) more than doubled last year. I announced in this year’s Budget to extend the Grant Scheme for Open-ended Fund Companies and Real Estate Investment Trusts for three years, which will attract more funds to domicile in Hong Kong. Our multi-pronged approach to fortify and enhance Hong Kong’s position as an WAM centre will continue.

Beyond being an active and efficient financial market, Hong Kong’s internationalised, safe and cosmopolitan living environment has made the city an ideal global hub for high-net-worth individuals.

According to a survey, there are 2 700 single family offices operating in Hong Kong, with more than half set up by ultra-high-net-worth individuals with assets exceeding US$50 million. Under the New CIES launched four months ago, more than 3 800 enquiries and over 340 applications have been received, with 117 cases approved in principle. If all the 300+ applications are approved, and taking an investment of HK$30 million per applicant, over HK$10 billion would be brought to Hong Kong. Meanwhile, non-Chinese Hong Kong permanent residents will be allowed to apply for Mainland Travel Permits starting this Wednesday. This news has excited many business executives of foreign enterprises in Hong Kong. The new arrangement is expected to attract more overseas high-net-worth individuals and professionals to come to Hong Kong and use the city as a base for developing their Mainland and Asia business.

The savings of residents in the Mainland, especially in the Guangdong-Hong Kong-Macao Greater Bay Area, are increasing. With the continuous deepening and expansion of mutual access between the financial markets of the Mainland and Hong Kong, Mainland residents will allocate some of their assets in Hong Kong. This will be conducive to the development of our asset and wealth management markets. “Cross-boundary Wealth Management Connect 2.0” came into effect in February this year. As at May 2024, the number of individual investors who participated in Wealth Management Connect had increased by about 42 000, and cross-boundary fund remittances had also increased by about RMB 44 billion.

For Hong Kong to uphold its status as a key global asset and wealth management centre, maintaining external connectivity is crucial.

The unexpected epidemic in 2020 hit the global aviation industry unprecedentedly, including Cathay Pacific Airways, a major airline based in Hong Kong. Considering the overall interests of the Hong Kong society, especially the need to safeguard Hong Kong’s status as an international aviation hub, and after weighing the needs of various social and economic sectors, I decided to invest $27.3 billion in Cathay Pacific through the Land Fund, comprising preference shares of $19.5 billion and a bridging loan of $7.8 billion. Last Friday, Cathay Pacific announced that it would buy back the remaining 50% of its preference shares from the Government within this month. This marks the steady return of Hong Kong’s aviation industry to full normalcy.

This special investment arrangement made during the unique period and circumstances resulted in a win-win situation. On the one hand, the Hong Kong-based Cathay Pacific gained liquidity to tide over the difficult times, and was able to restore its capacity more quickly. At the same time, the investment brought a return of around HK$4 billion to the Government.

We look to Cathay Pacific to continue to improve service quality, thus supporting and enhancing Hong Kong's position as an international aviation hub. Looking forward, local airlines should actively expand their route networks in response to the needs of economic development, business connections, and travel by members of the public. This will complement our country's development of the "Air Silk Road," facilitate visitors to come to the city, and help Hong Kong businesspeople and residents go global. This will open up greater business opportunities for Hong Kong, and make travel more convenient. As Hong Kong strengthens its ties with the Middle East, Cathay Pacific will launch direct passenger service to Riyadh, the capital of Saudi Arabia, in October. More convenient travel between the two places will certainly forge closer connections between the two markets, helping to attract new capital and create new opportunities for Hong Kong's financial markets.

July 7, 2024