Blog

Visiting Saudi Arabia again

Last week, I led a business delegation of over 100 members, including representatives from the finance as well as innovation and technology (I&T) sectors, on a visit to Riyadh, Saudi Arabia. Thanks to the collaborative efforts and hard work of all delegation members, the trip was highly fruitful. We witnessed and facilitated a number of joint projects, including the listing of financial products in the Saudi market, signing of investment and business co-operation agreements, pitches by startups, and more. We could all feel the unique value and significant potential of the "Hong Kong brand" in overseas markets. These have paved the way for us to deepen our cooperation with the Middle East market and to better contribute to the Belt and Road Initiative.

|

| Last week, I led a business delegation of over 100 members, including representatives from the finance and I&T sectors, on a visit to Riyadh, Saudi Arabia. |

|

| During the visit to Riyadh, I attended the Future Investment Initiative (FII) and spoke at one of its thematic discussion sessions. |

Key achievements from this trip include:

1. We witnessed the listing of the first two exchange-traded funds (ETFs) tracking Hong Kong stocks on the Saudi exchange, which marks a significant milestone for two-way capital flow. Notably, one of these ETFs is the largest of its kind in the Middle East. The listing of the first ETF in Hong Kong that invests in the Saudi market last November, along with the recent listing of the two Hong Kong stock ETFs in Saudi Arabia, serves as an excellent example of financial connectivity along the Belt and Road.

2. The Hong Kong Monetary Authority signed a memorandum of understanding (MoU) with the Public Investment Fund (PIF) of Saudi Arabia to jointly establish a US$1 billion investment fund. This fund will focus on investing in companies connected to Hong Kong and the Guangdong-Hong Kong-Macao Greater Bay Area engaged in sectors such as manufacturing, renewable energy, fintech, healthcare, etc. to expand in Saudi Arabia. This initiative will provide a platform for these companies to expand their international business.

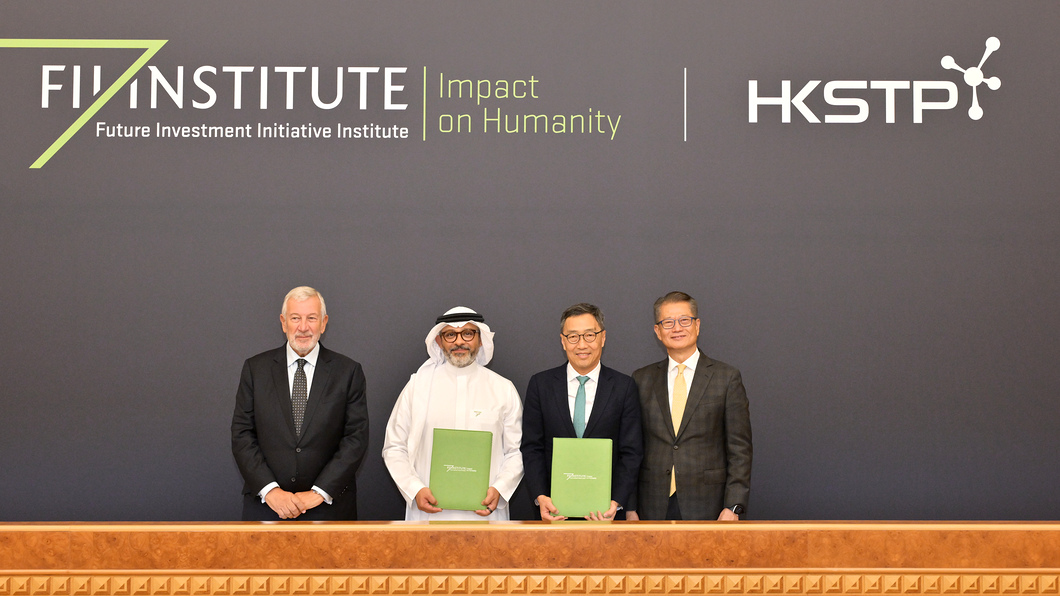

3. At the institutional level, the Hong Kong Science and Technology Parks Corporation (HKSTP) and the Hang Seng Indexes Company Limited each signed a cooperation agreement with their Saudi counterparts, including the FII Institute and the Saudi Tadawul Group respectively, to enhance collaboration, exchange, and knowledge sharing.

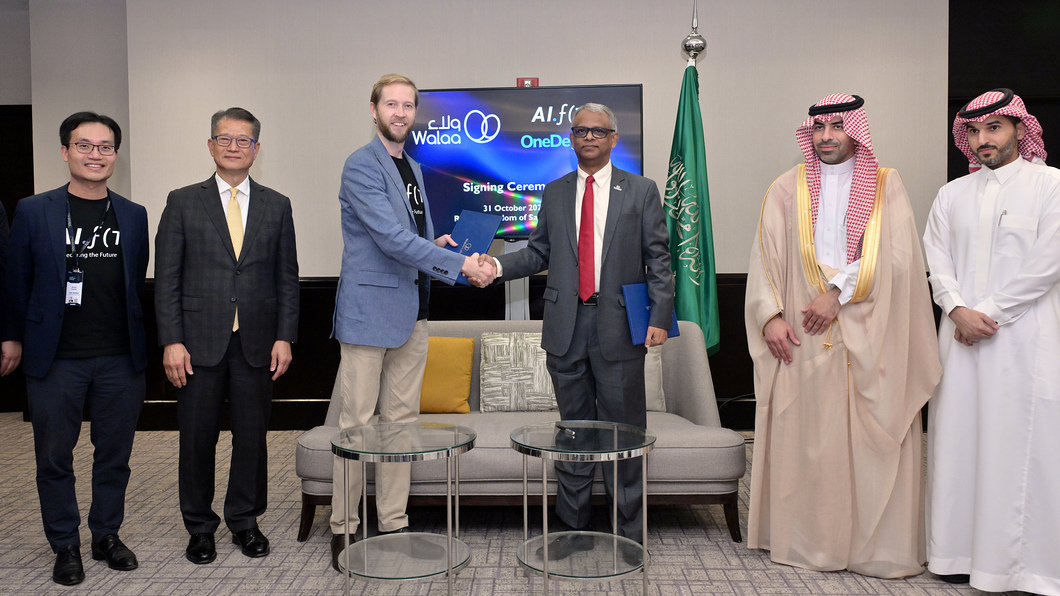

4. At the corporate level, over 20 startups from Hong Kong pitched their ideas during FII. Several have already received invitations from Saudi investors to further explore potential business cooperation. Among them, seven startups signed MoUs with Middle East enterprises and institutions to jointly investigate development opportunities and application scenarios. In addition, a fintech company from Cyberport signed business agreements with its local partners.

5. We actively engaged with Saudi investors and financial regulatory authorities, and both sides will explore opportunities for cooperation in financial services, product development, and talent training in greater depth.

|

| In Riyadh, I attended the listing ceremony of the Albilad CSOP MSCI Hong Kong China Equity ETF on the Saudi Exchange. |

|

| I officiated at the SAB Invest Hang Seng Hong Kong ETF Listing Ceremony with other guests. |

|

| Alongside H.E. Yasir Al-Rumayyan, Governor of PIF (back row, right), I witnessed the signing of an MoU between the Hong Kong Monetary Authority and PIF for the establishment of a new investment fund. |

|

| Along with Mr Richard Attias, CEO of the FII Institute (first left), I witnessed the signing of a co-operation agreement between the HKSTP and the FII Institute. |

Two years ago, I embarked on a business trip to Saudi Arabia. Since then, both the HKSAR Government team and representatives from the business and financial sectors have made numerous visits to Saudi Arabia at various levels, striving to enhance mutual understanding and deepen our friendship. Building on this foundation, along with the advancements of Saudi Arabia's 2030 Vision and the evolving geopolitical landscape, our recent visit has yielded more substantial outcomes, enabling us to facilitate broader collaboration.

As various sectors in Saudi Arabia have gained a deeper understanding of Hong Kong's role, strengths, and value, we have established a solid foundation of mutual trust for co-operation between our two regions. Whether participating in FII events or engaging in meetings with local counterparts from the finance and I&T sectors, our delegates felt a strong eagerness from the local participants and partners to collaborate with Hong Kong, and to firm up details of collaboration and expedite the process. In fact, some members of the delegation are still in Riyadh, or are planning to return to the Middle East in the coming weeks to continue their discussions with local partners.

|

| I witnessed the signing of MoUs between seven startups from the HKSTP and Middle East enterprises and institutions. |

|

| I witnessed the signing of a commercial agreement between a Hong Kong fintech company and a Saudi financial institution. |

The first FII Priority Asia Summit was successfully held in Hong Kong in 2023. We are actively discussing with the FII Institute about hosting the second summit in Hong Kong in 2025, which will once again attract global financial and investment leaders to our city.

This visit has deepened our appreciation for the unique value of the "Hong Kong brand."

In our discussions with representatives from various institutions in the Middle East, they consistently highlighted Hong Kong's mature and efficient financial market, its diverse and innovative products, high standards of professional services, and alignment with international standards across multiple areas. They also noted our regulatory system, which has evolved through various cycles and challenges. These attributes make Hong Kong an important reference point for them in driving financial market reform and development, helping them better prepare for risks and challenges.

In the realm of I&T, where new products and solutions from Hong Kong have been certified and commercially applied, they provide assurance to our Middle East partners for large orders and collaborations. In infrastructure, Hong Kong excels in design, construction, and operation, and our professional services firms, developers, and contractors are welcomed in Saudi Arabia. In fact, some construction-related professional services providers from Hong Kong have already secured contracts and commenced operations in the region.

|

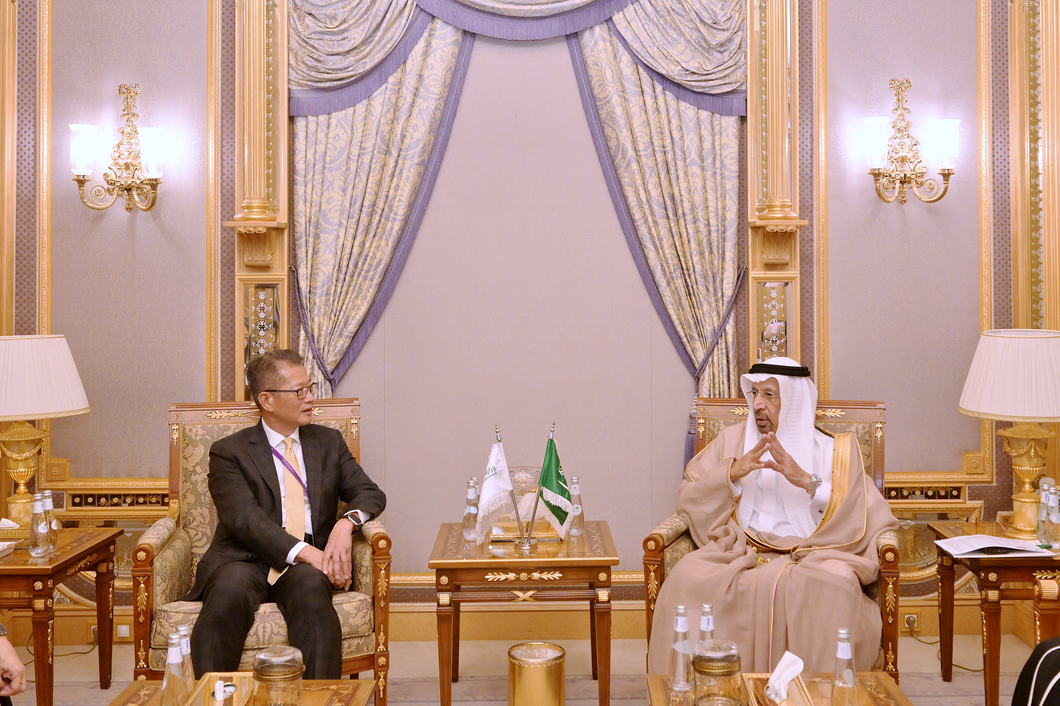

| During the conference, I met with H.E. Khalid Al-Falih, Minister of Investment of Saudi Arabia. |

|

| I co-chaired a capital market roundtable session with H.E. Mohammed bin Abdullah Elkuwaiz, Chairman of the Saudi Capital Market Authority. |

Moreover, during our meetings and exchanges, many Middle East investment institutions indicated that Hong Kong’s international character and diversity, along with our respect for various cultural values, create a solid foundation for deeper co-operation based on mutual respect and benefit. For them, Hong Kong serves as a "super connector" that not only links the Mainland with traditional Western and Middle East markets, but also extends to emerging markets with diverse backgrounds and cultures.

Looking ahead, we will intensify our efforts to leverage the city’s potential and strengths in this area. In addition to establishing bilateral connections with various emerging markets, we aim to weave these connections into a broader and tighter network of relationships, thereby building a more robust business, financial, and I&T ecosystem.

In fact, we share many commonalities with Saudi Arabia in our development approaches and strategies. For instance, Hong Kong is actively guiding technological research and development and industry clustering through co-investment, aiming to support industry growth with "patient capital." This includes fostering a vibrant ecosystem for economic diversification. Many Middle East countries, including Saudi Arabia, have also been promoting economic development, technological applications, green transformation, and industry diversification through strategic investments in recent years.

Take finance as an example. The diverse financing needs of various development projects in the Middle East present opportunities for us to develop infrastructure financing, revive Islamic financial products, and enhance the promotion of asset and wealth management services. Accelerating the dual listing of companies on exchanges in both regions could attract Middle East enterprises to list in Hong Kong, drawing capital from the Middle East market, including its offshore Renminbi (RMB) holdings. This approach will enhance Hong Kong's market liquidity, further boost our offshore RMB business, and offer Hong Kong investors more opportunities to invest in projects in the Middle East.

Our deepening cooperation with the Middle East certainly extends beyond finance, I&T and investment. The Islamic culture of the Middle East has deep historical roots, with over a thousand years of exchanges and dialogues with our country. As an East-meets-West centre for international cultural exchange, Hong Kong can play a vital role in promoting people-to-people interactions and cultural exchanges, thereby fostering closer ties between the two regions.

November 3, 2024